Risk Management

ICH Risk Management intended to ensure risks are taking in a prudent manner for justifiable business reasons by maintaining risks at acceptable levels in mature business, whilst taking higher risks where strategically necessary in new ventures (new products, businesses) for all stakeholders.

Risk management in ICH has been developed with reference to the best international market principles, expressed in the principles of the Financial Market Infrastructure (FMI) published by the Bank of International Settlements and the International Organization of Securities Commissions, (BIS OICV-IOSCO) .

Risks can be interpreted as the potential of a case in an event that will potentially cause losses in the company, and is managed by a series of procedures and methodologies adopted to identify, assess, monitor and control the risks that arise in the business and operations of the company.

Basic Risk Management Strategies

1. Basically controlling and risk management within a company is to take risks whose scope of control is carried out by the board of directors and other organs in terms of business strategy implementation.

2. The rationale for controlling and risk management comprehensively controls and manages company risks by using uniformity wherever possible.

3. Comprehensive risk control and management as a principle in achieving a stable company profit that is balanced with risk, achievement in accordance with capital structure and allocation of resources, and other achievements, by identifying / recognizing, evaluating / calculating, controlling, and monitoring / report all risks.

4. Monitoring and reporting: The process of renewing risk oversight status and exception treatment, as well as reports to Executive Management by an independent Risk Management Department (RMD).

Risk Management Process

In order to control and manage each risk appropriately, the following processes must be combined in an adequate manner.

1. Identifying and recognizing risks: The process of identifying types and location of the risks of each transaction, portfolio, and things that are apply.

2. Evaluating and calculating risk: The process of making risk status indicators using numeric values, or a comprehensive qualitative assessment for the level of individual transactions and portfolio levels.

3. Risk control: The process of controlling the status of risk by testing and reviewing authority, boundaries, operational processes, and other matters (including planning for exception treatment). This is stipulated in policies, regulations, procedures, directives, and other methods of control.

Risk Mitigant

ICH's role in the risk mitigation process required by Clearing / Member Members is to minimize or manage the occurrence of a risk.

MARGIN

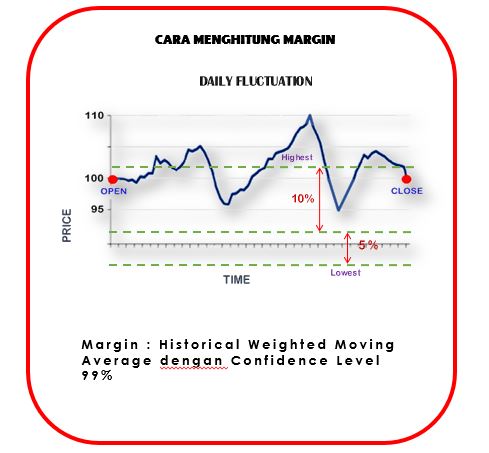

Pre-trade margining is used by ICH to deal with risks to obligations on trade contracts. Margin that functions as a risk premium will be set to a certain level adjusted with the potential risk of each transaction that will be carried out. With using a margining system, trading costs are much lower than if a member is charged a risk premium fee.

VOLATILITY & MARGIN CALL

The risk inherent in the transaction position is calculated regularly by ICH based on the development of market conditions, and if the member's deposit margin is no longer sufficient to cover the risk, the Member will be asked to make a margin deposit. When Member's margin deposit is insufficient and is not fulfilled on time, ICH can forcibly close existing trading positions.

CROSS MARGINING

Market participants will arbitrate between their contracts, not merely paying attention to the price movements of the contract itself, but to the price relationship between the two contracts. If there is a negative correlation between two positions held by market participants (that is, if the price is one the contract rises, the other prices tend to fall) then the combined risk is taken by participants who have two contracts lower than the risk of each single contract. ICH acknowledges this, and allows a reduction in margins for such combined positions which are called "spread margins" or also, "cross margins".

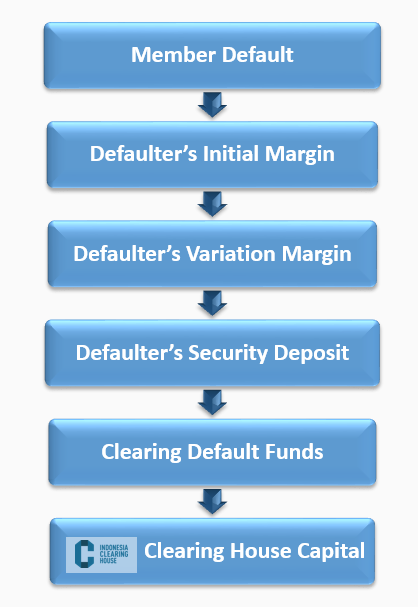

RISK WATERFALL

Definition and Method of Calculating Margin

Margin is a sum of money and / or securities that must be placed by a customer in a futures broker, a futures member broker in a term clearing member, or a term clearing member at a futures clearing house to guarantee the implementation of futures contracts, sharia derivative contracts and / or other derivative contracts .